1.- Introduction. Balance Sheet Structure (Free Preview)

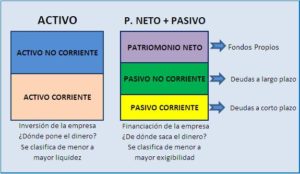

The Balance of a company has the following structure:

In the Active What the company owns is accounted for, while in the Passive The sources of funding you have used are listed.

Attention: sometimes there is a tendency to interpret Liabilities as what the company owes. This interpretation is not correct; in fact, equity is accounted for in Liabilities

One of the basic accounting standards says that the Asset will always be equal to the Liability (This equality will always be fulfilled.)

The Order In which the accounts are presented is:

In the Active Accounts are collected from highest to lowest liquidity.

In the Passive The order is from highest to lowest degree of demand.

The main groupings in the Balance Sheet are:

Current Assets (AC): includes those elements that are used directly in the activity carried out by the company and that rotate (they remain in the company for less than 1 year).

Non-current assets (ANC): these are elements that are used in the activity carried out by the company but that are maintained in the same activity for several years.

Current or Short-Term Enforceable Liabilities: items that are due before one year, i.e. debts and obligations payable in the current year.

Non-Current or Long-Term Receivable Liabilities: items that are due in a period of more than one year, i.e. debts and obligations to be paid in the next year(s).

Net Worth or Equity: It collects the company's equity, i.e. the money contributed by partners, reserves and undistributed profits obtained from the business.

The first concepts to take into account:

Equity always has to be positive, if it were negative the company would be bankrupt and would not be able to continue operating.

The higher the own funds, the greater the solvency of the company

The current assets must be greater than the receivable in the short term, otherwise the company would be in receivership, it would not be able to meet its short-term payment obligations.

A company may be in receivership (liquidity problems), even though it has very high equity.

This second idea is a general rule, since in certain activities companies may operate with current assets lower than those required on a c/p.